Exploring Upstream.Exchange: A New Chapter in Digital Trading

Understanding Upstream.Exchange

A Look at Upstream’s Next-Level Trading Experience

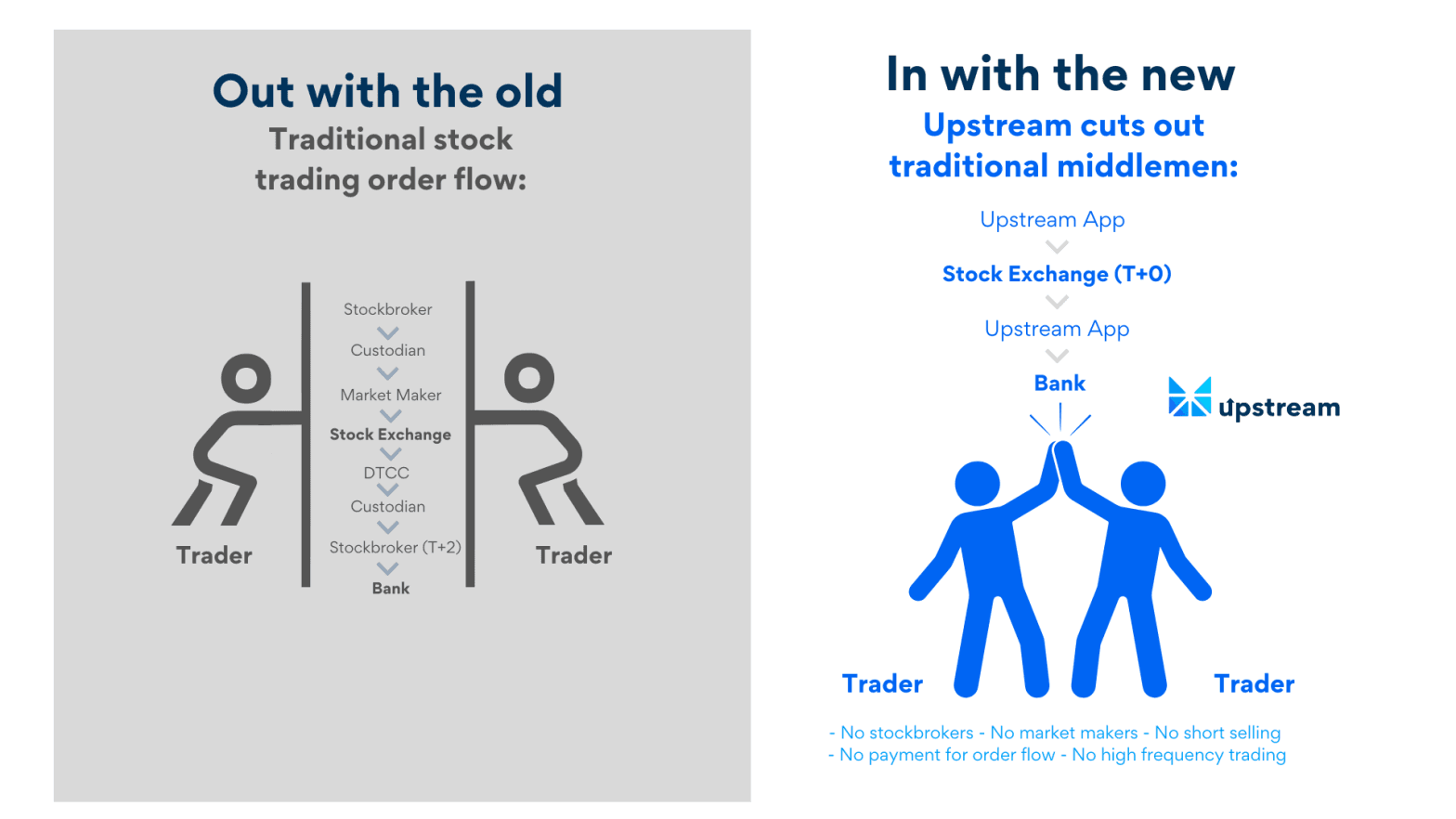

When it comes to reimagining today’s stock trading landscape, Upstream is challenging the status quo with a modern approach that puts power directly into the hands of investors. Traditional exchanges typically depend on brokers, restricted funding options, and limited trading schedules, but Upstream creates an entirely different environment—one that features direct access to a peer-to-peer market, real-time trading, flexible deposit methods including PayPal and USDC, and the freedom to trade 20 hours a day, seven days a week.

Built on blockchain technology and engineered around investor-friendly tools, Upstream offers an innovative way to trade. Below is a side-by-side comparison of what sets Upstream apart from more conventional trading platforms:

Trading on Upstream

Direct exchange access

While many platforms simply provide a window into exchanges, Upstream is part of the MERJ Exchange, giving investors direct market access through the Upstream trading app.

Multiple funding methods

Investors can use credit/debit cards, PayPal, or USDC digital currency for quick, convenient account funding.

Transparent market practices

By eliminating short selling, payment for order flow, and market maker lending, Upstream promotes a fair trading space that mitigates conflicts of interest.

Non-custodial accounts

You retain total control of your cash and securities—no third-party platform is involved. Biometric verification is required for each transaction, providing additional security whenever you buy, sell, bid, auction, or withdraw.

Extended trading hours

Smart contract execution allows Upstream to offer 20/7 trading, enabling you to buy and sell regardless of time zone or business hours.

Instant settlement and peer-to-peer execution. All bids and offers are visible to users at no extra cost, and trades finalize immediately on a best bid/offer basis.

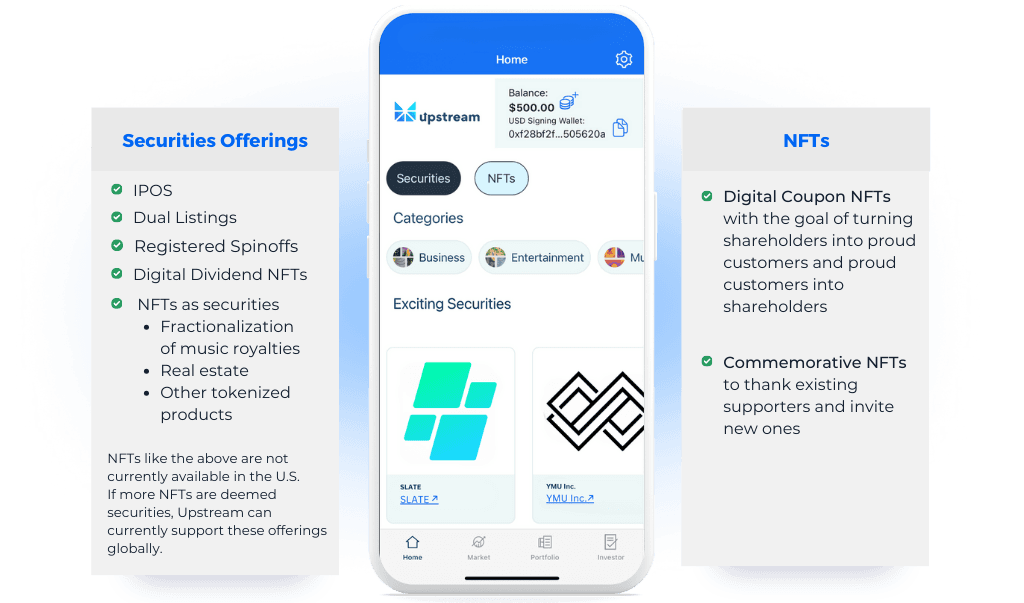

IPO support and fractional ownership

As a fully regulated market, Upstream is a peer to the OTC markets. Qualified issuers can cross-list MERJ and Upstream securities in other markets worldwide. The platform also supports tokenization and fractionalization for broader investor access.

Integrated digital coupons and collectibles

Companies can engage shareholders with unique digital coupons, turning them into customers—and vice versa.

Trading on Traditional Platforms

- Often requires a broker to access the market.

- Payment methods may be limited to older, slower options.

- Short selling and payment for order flow may be standard practice.

- Investor assets may be held by the platform rather than in non-custodial accounts.

- Trading hours typically mirror standard business schedules.

- Settlement can take days (T+1 or more).

- Capital-raising features and direct fractional ownership are usually limited or unavailable.

- Shareholder engagement tools are minimal or nonexistent.

Upstream is redefining capital markets for a contemporary audience—ditching legacy constraints and introducing a blockchain-powered model that emphasizes visibility, accessibility, and equitable trading practices.

Stay tuned for updates on upcoming opportunities with Upstream. Issuers interested in a listing can begin the process today, while non-U.S. investors can download the Upstream app on iOS or Android and start exploring what next-generation trading truly looks like.

Note: U.S. persons may not deposit, buy, or sell securities on Upstream.

How to Get Started with Upstream.Exchange

Getting started with Upstream.Exchange is straightforward. The platform offers a simple registration process, allowing users to set up their accounts quickly. Once registered, users can begin trading by depositing funds into their accounts.

For those new to digital trading, the platform provides educational resources and support to help them navigate the complexities of the market. This ensures that even beginners can confidently engage in trading activities.